A fundamental tenet of options trading is the capture of as much implied volatility (IV) premium as possible as a net sellers of options in a high IV context. To refine my trade entries, management, and exits, I’ve been doing a bit of research to better under backwards-looking, historical, statistical data in order to formulate forwards-looking, predictive, probabilistic trading.

(Note: It’s important to distinguish between these two since they’re often conflated. In grad school, I had a debate that power laws describing severity vs. frequency of events are descriptive statistical empirical facts and just NOT be confused with predictive and probabilistic in theoretical models.)

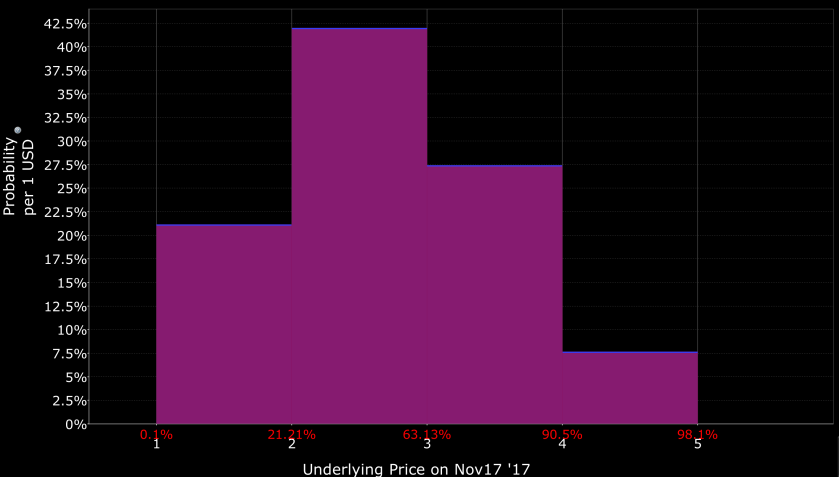

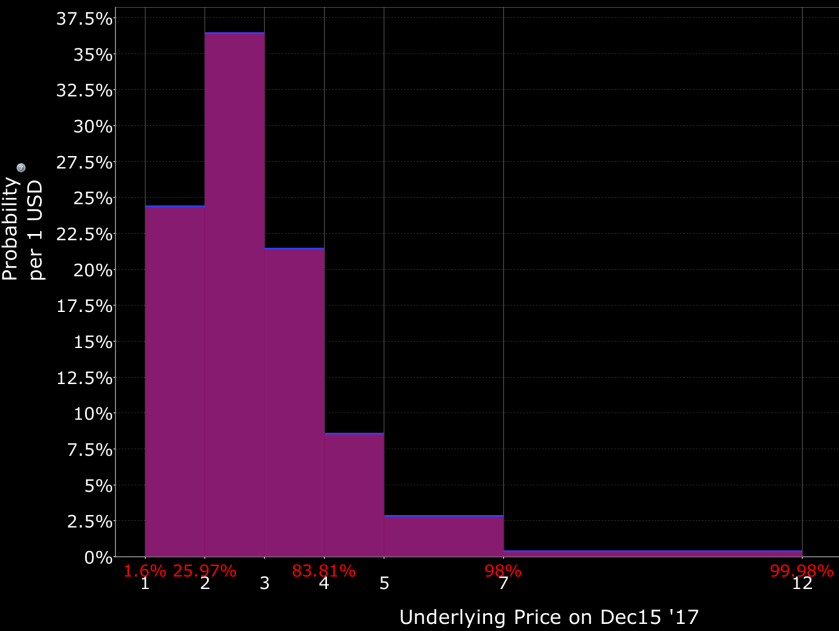

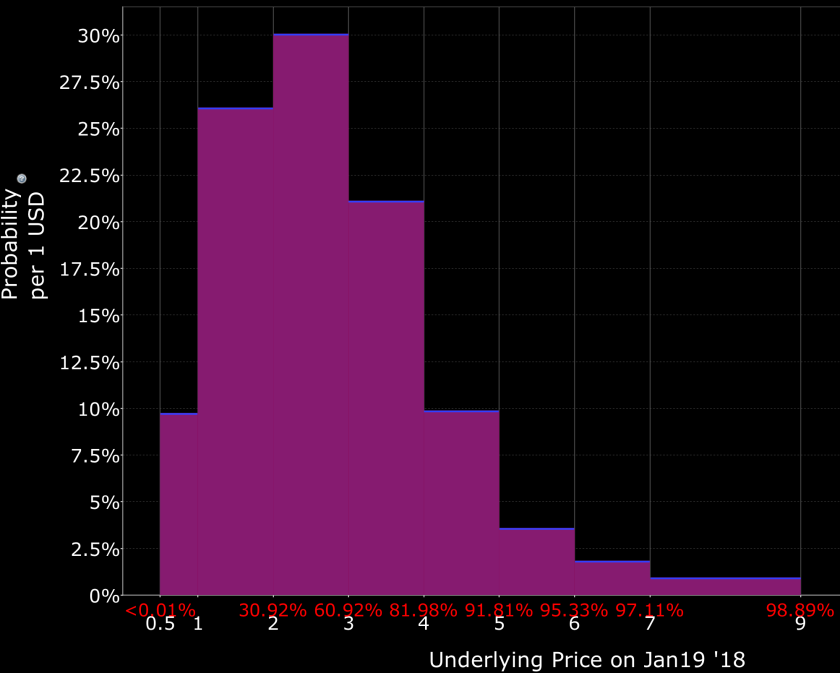

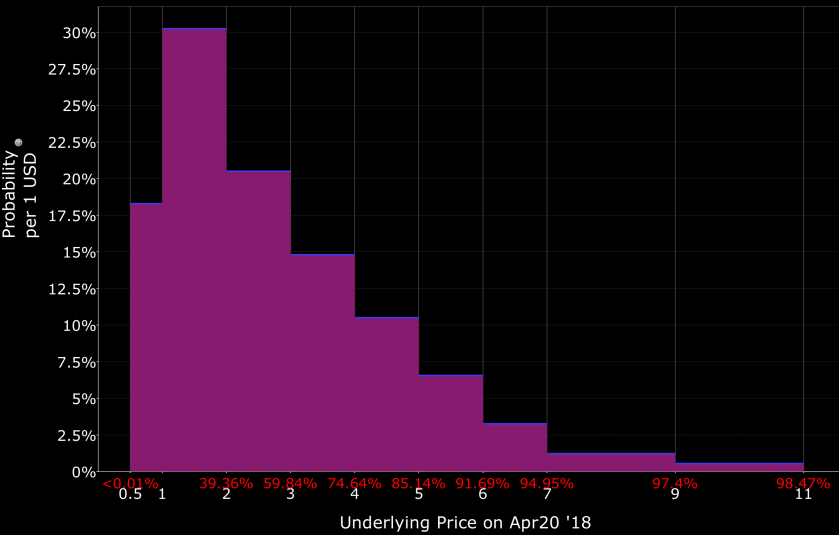

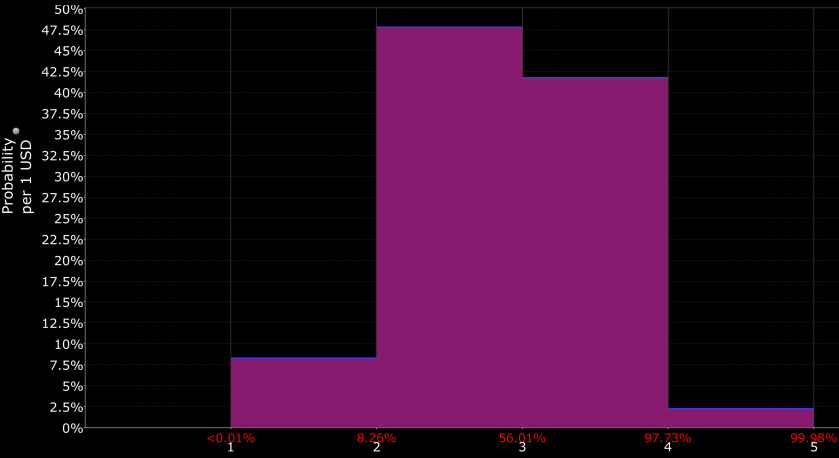

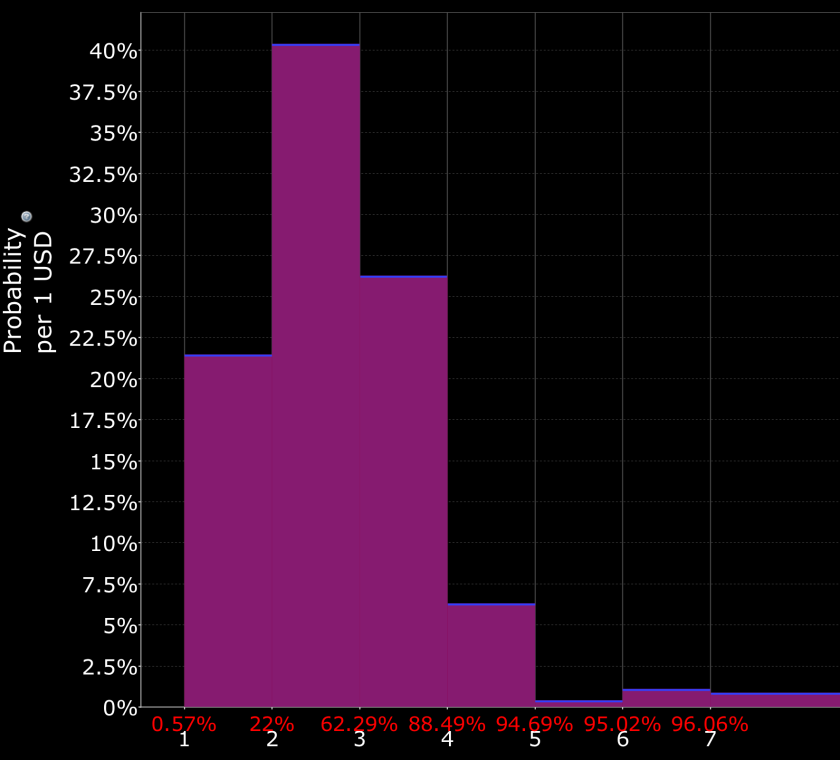

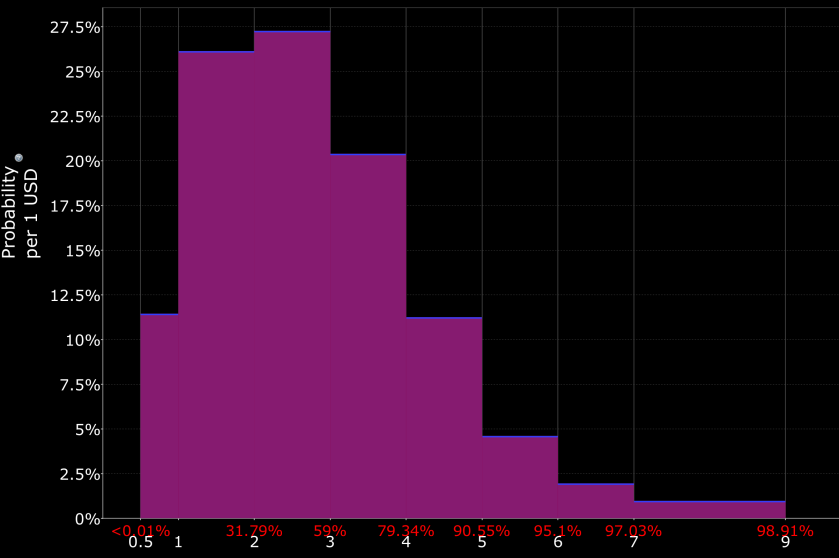

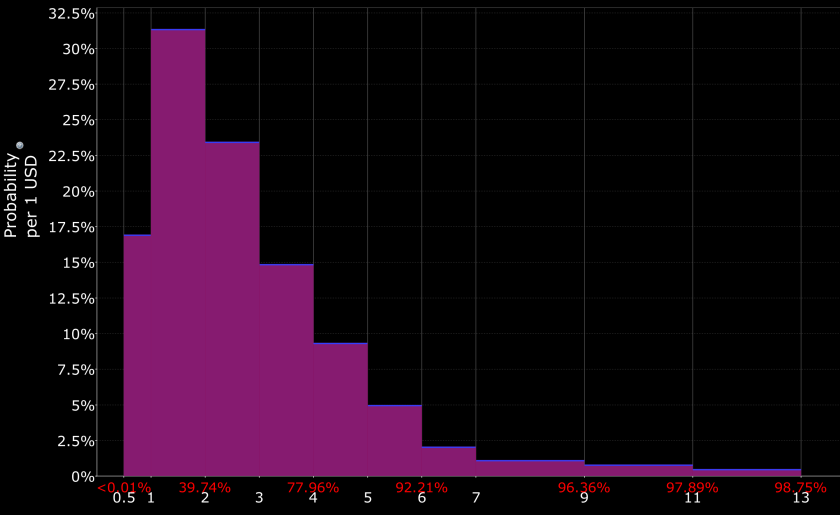

One strange phenomenon is the shape of IV as a function of strike price for the same-expiration options across the option chain. Black-Scholes predicts a flat shape, but what we encounter are as we move away from at-the-money (ATM) options to out-of-them-money options is an upward sloping graph.

Furthermore, there tends to be a skew to this graph such that lower OTM Put strike prices tend to have greater IV than higher OTM Call strike prices.

Indeed, we see this in the real world as well.

The main related questions I have are:

- Why are out of the money options increasingly more expensive?

- Why are out-of-the-money OTM Puts more expensive than OTM Calls?

It would appear that there are two distinct reasons underlying both of these phenomena that make sense.

Reason: Higher uncertainty further away from strike price

Options pricing models are obviously not terrain, but only a map of the terrain with many simplifying assumptions and parameters that may render the model decreasingly with increasing uncertainty. This diminished usefulness and greater uncertainty manifests itself as an increasingly larger premium that deviates to a greater degree from options pricing models the further away the strike prices are from the market.

Reason: Prospect Theory

One of the main findings of Prospect Theory, for which the Economics Nobel was given to Kahneman and Smith in 2002m is that people tend to be more risk seeking when down and tend to be more risk averse when up. A real life example of this many can relate to is increased risk seeking when losing in poker vs. decreased risk seeking when up. The same magnitude of loss hurts more than the same amount of gain is pleasurable (or relatedly, missing out on greater potential gains), so people will act to minimize losses and lock in gains. The volatility skew showing greater IV at lower strike prices would imply that people are willing to pay more to avoid the pain of a loss, than to capture the pleasure of a gain.

I realize there’s MUCH more to consider, but this is enough for me to “explain” this market phenomenon.

What are practical implications for trading based on these empirical facts and theoretical reasoning? It would seem that, in addition to and after the fundamentals of options trading, the following heuristics may hold as a second-order refinement:

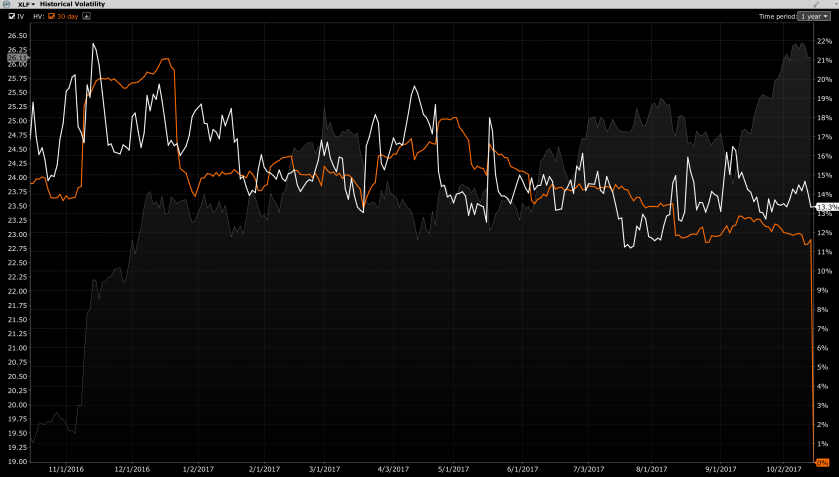

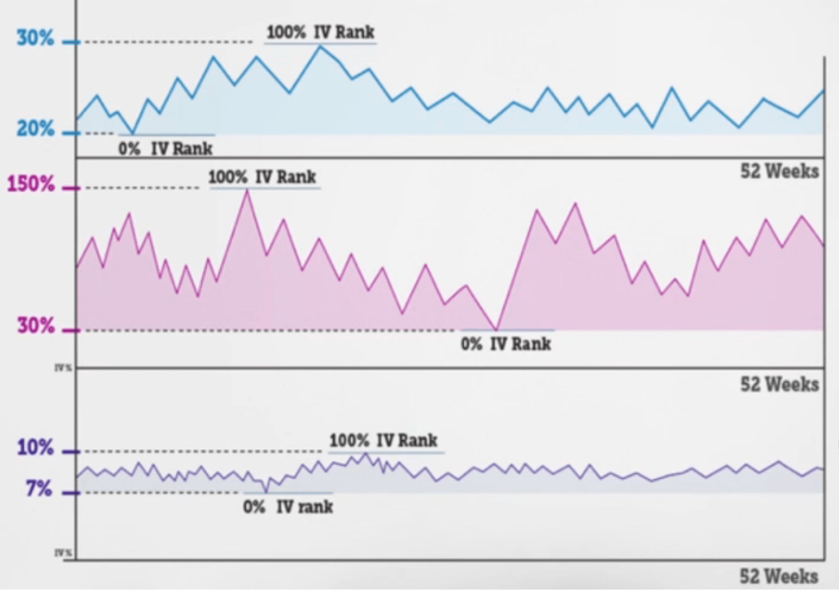

- As a net seller of options in a high IV environment (greater than 50th percentile IV rank and/or percentile – using these terms rank and percentile interchangeably for expediency even though I know they really aren’t):

- Prefer to do so away from the strike price to capture the greater IV premium

- Prefer a more Bearish outlook to capture the greater IV premium on the downside relative to the upside

- As a net buyer of options in a low IV environment (lower than 50th percenile IV rank or perentile)

- Prefer to do so closer to the strike price so as to pay a lower IV premium

- Prefer to do so with a more Bullish outlook if out of the money pay a lower IV premium to the upside relative to the downside