Bitcoin and Cryptocurrency trading is an interesting case study in emotions, especially in Envy and Greed. These are the observations as someone who never bet anything on either Bitcoin or cryptos. I haven’t written much about cryptos before, but they’re an interesting case study in the context of the emotions of Envy and Greed. Just trying to dig deep into my own head so I don’t make mistakes trading “normal” equities and options. (I personally refrained since I had no money to bet at the time, was afraid to lose, and was ramping up on options trading.)

1. Envy

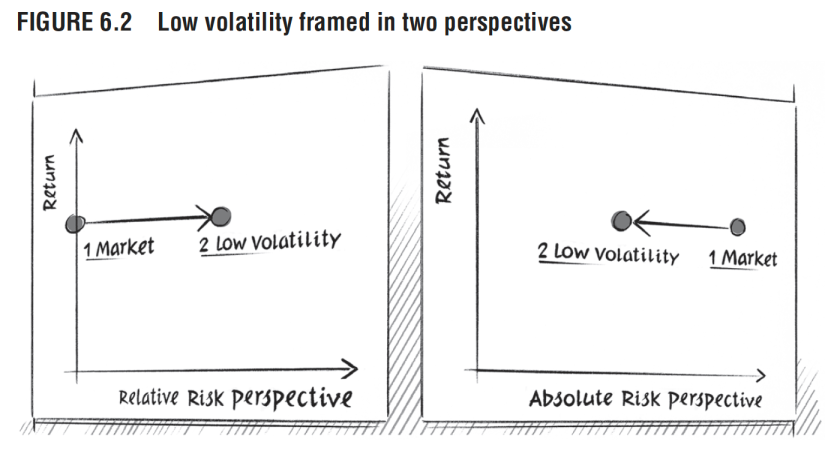

Those who weren’t invested were “extremely” envious of those who made a crapload of money for no reason. It’s important to distinguish Envy vs. Greed.

Envy arises when comparing yourself to someone else, and comes from “relative” wealth. In contrast, greed is what you yourself have and is “absolute” wealth.

I’ve personally been mindful to channel any envious comparison to personal greed. These emotions are powerful and can destroy you if you don’t really understand them since they come from our evolutionary history and there’s no way to turn them off, but rather to go around them and/or channel and leverage them for useful purposes.

As a nuanced point, Jealousy is an emotion that requires both a 2nd Party, and a 3rd Party that threatens to take you already have with the 2nd Party. It’s usually involved in romantic/sexual relationships, and not usually directly related to trading/investing and economic wealth.

Greed is good. Envy is bad.

2. Greed and Fear

The ones who see others make a lot of money feel greed and want to get into crypto as well, but are too fearful to bet their own money. It’s as simple as that.

3. Crash and Self-Righteousness

Cryptocurrency and Bitcoin goes back down. Phew! The Envy has subsided a bit and the “I Told Ya So” and “They were so Dumb” statements come freely and in full force as a backwards-looking justification, vindication, and source of self-satisfaction.

4. Self-Confidence and Self-Esteem

The core here to rise above the riff raff is self-confidence and self-esteem for a healthier mind, so the following thoughts, and similar can exist instead.

– It is 100% OK that I have nothing absolutely and less relatively, since I’m happy with myself and my life.

– Those who made a crapload of money also risked a lot and could’ve lost. I did not risk anything, so therefore I have no right to be envious since I had no Skin-In-The-Game.

– I should be happy for other people’s success and try to learn from their success, rather than be envious, especially if I did not risk myself.

– Greed is good. Envy is Bad.