I’ve been doing research into all aspects of volatility to complement my options trading and VIX ETN trading.

There’s a fascinating “anomaly” concerning returns being an inverse function of volatility, flying in the face of intuition and a huge theoretical edifice that returns should actually be a direct function of volatility. The framework for this was mostly built by economists and academics who spend too much time on theory and not enough time on the day-to-day profit/loss trading their own capital.

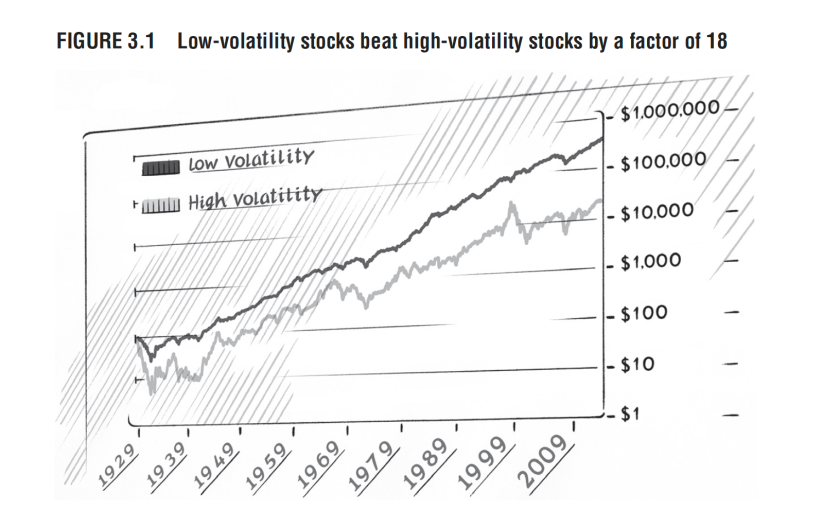

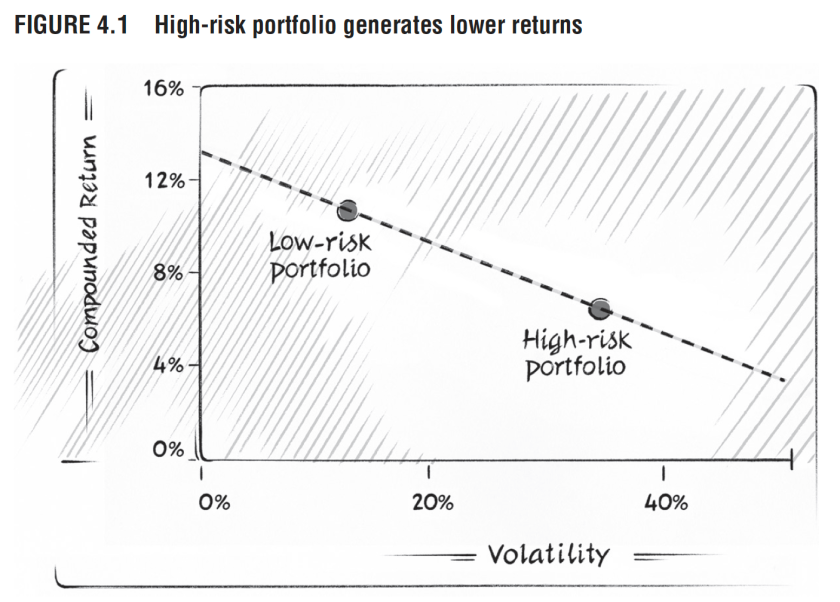

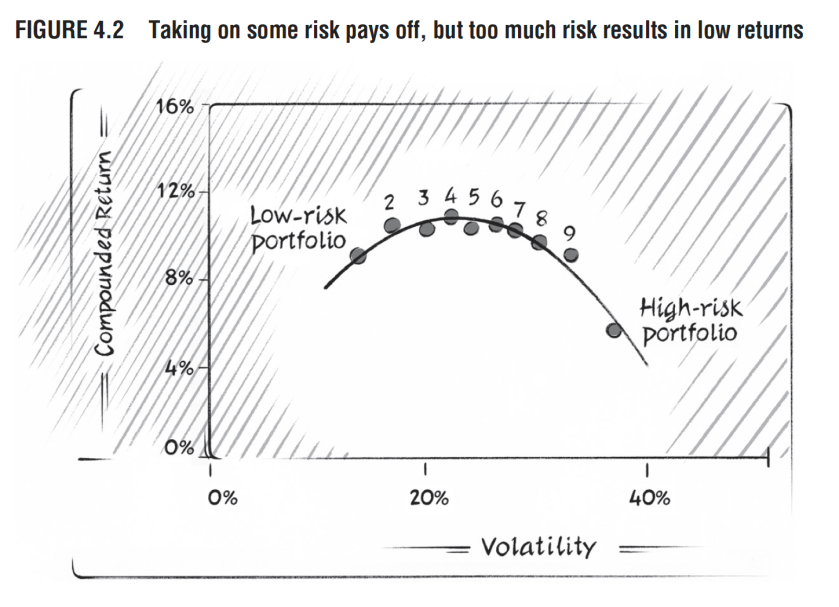

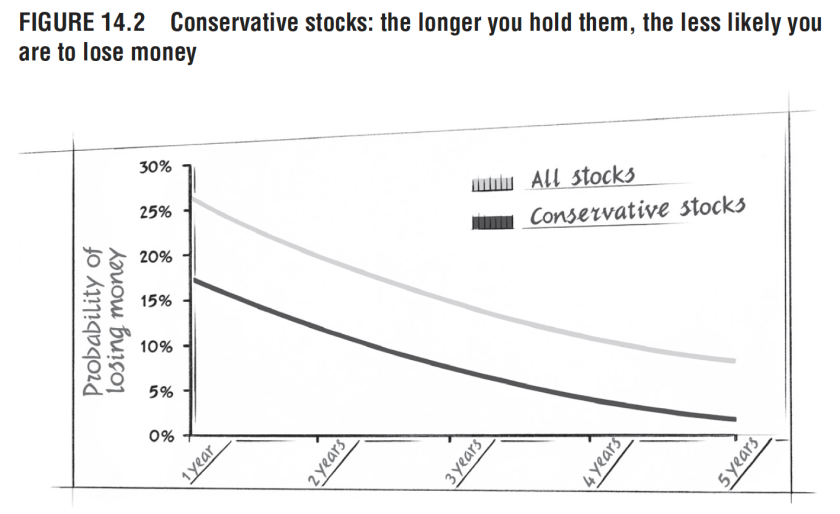

In other words, a portfolio of low volatility equities actually provide a better return than high volatility equities, since they tend to lose less during stress periods. Interestingly, this is related to how performance may be reported. Mathematically, the geometric average of return is calculated over multiple periods of time, as opposed to arithmetic averages of return calculated period-by-period. As an example, if a position loses 50% then gains 100%, then the arithmetic average return is 25%, whereas its geometric return is 0%. Talk about obscuring performance. (As an aside, this difference between arithmetic return and geometric return is at the heart of risk or money management frameworks like the Kelly Criterion, in particular, maximizing absolute portfolio growth over long periods of time using geometric averages, or about maximizing arithmetic averages over single periods of time for emotional reasons.)

At the end are some screenshots from fund manager Pim Van Vliet’s High returns from low volatility. Two other very important books are:

– Falkenstein – Missing Risk Premium

– Falkenstein – Finding Alpha

In addition, there are numerous published works on low volatility investing on these two authors and others. Best place to find them is SSRN.

Combine the framing of these returns along with fund manager compensation and fund investors benchmarks being tied to specific short periods more aligned with “arithmetic” average as opposed to multiple periods aligned with “geometric” averages, and that’s why this anomaly exists and persists in the investment industry.

This brings up two interesting philosophical issues: one concerning the nature of the relationship between related concepts of volatility, risk, and uncertainty, and the other about the human emotions of envy and greed.

These are distinct issues, but tend to be conflated together both conceptually and mathematically. I admit my definitions are not precise either.

– volatility (quantified movement)

– risk (potential for loss or bad outcomes that can be described by mean, proxied by volatility, and usually with higher moments of the distribution such as skew and kurtosis are not considered)

– uncertainty (in principle unquantifiable, but loosely proxied by statistical measures of risk like variance, skew, and kurtosis).

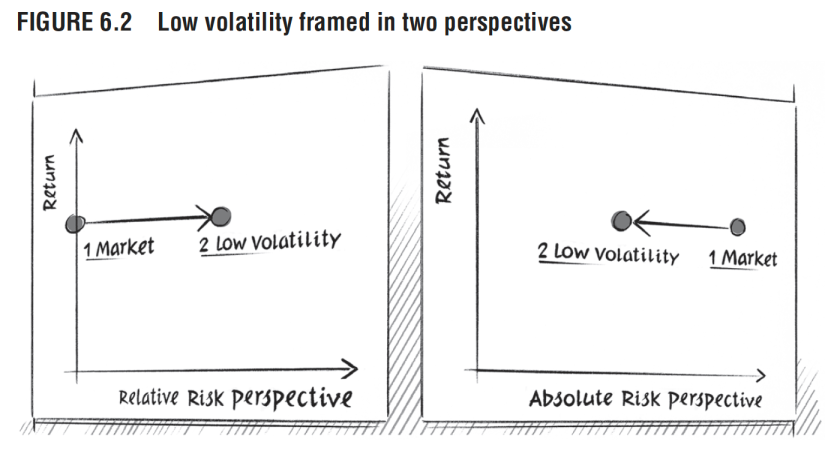

Concerning envy and greed, since fund manager performance is tied to “relative” returns to a benchmark, usually the market benchmark for their compensation and other managers for emotional and psychological reasons, instead of “absolute” returns, there’s an interesting mapping to envy and greed. Basically, “envy” arises from comparisons in terms of “relative” wealth acquisition or performance vs. greed that is more closer to “absolute” wealth acquisition and performance.

GREAT POST! Love the way you described and introduced the idea off low volatility stocks over high risk.

LikeLike