Is working harder or more necessarily better?

It’s been about 5 months since I started on this options path, internalized options theory via all forms of media (podcasts, youTube videos, blog posts, news articles, academic articles, forums, StockTwits/Twitter, writing in this blog, etc.), and applied the principles in end-to-end practical trading matters, and now have under my belt the execution of hundreds of trades.

Much of the middle three months of those last five months was dedicated to writing a 4,000-line Python program to connect with the Interactive Brokers API.

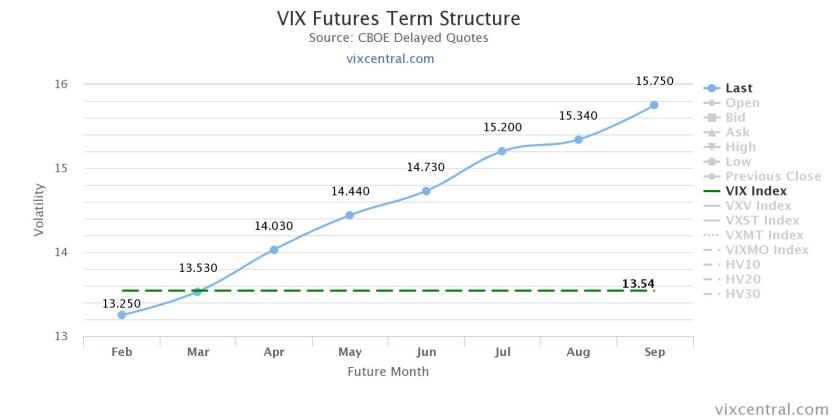

The past month or so was when I found out about VIX, internalized the main ideas by a few books, dozens of podcasts/videos, and dozens of articles. I’ve started unwinding the rest of my options positions to focus exclusively on shorting options on $VIX-derived ETPs, especially $VXX. All this is detailed in the most recent couple blog posts.

Now that my focus has shifted to $VIX, unfortunately much of my work in writing the Python program simply isn’t needed anymore. There were many moving parts in filtering candidate underlying stock, ETFs. and options chains, constant scanning for high implied volatility setups, ingesting and managing the tick data, formulating trade entry/management/exit, and a few other components such as determining earnings dates that simply are no longer needed with this new focus on $VIX.

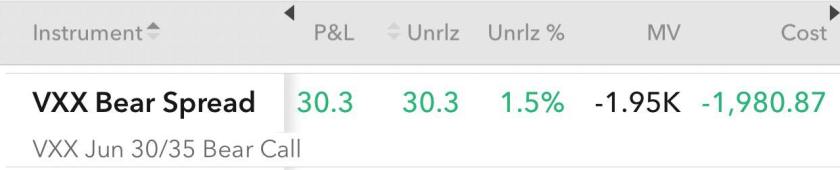

Fortunately, I gained a lot of excellent knowledge in practical coding/data/trading matters when it comes to writing a comprehensive trading program, and furthermore, know that I don’t need to write another anticipated 20,000 lines, at least, to do all the things I wanted to automate away. I’ll still be using parts of the program such as, for example, automated trade execution for large blocks of options since IB only permits 5 contracts at a time. To give a sense of how that 5-contract limit fits into my trading, I have close to 200 total options contracts in 100 spreads currently outstanding on $VXX call spreads alone. Also, tasks like scanning all SP500 companies’ underlying volume, option chains, and earnings dates for earnings trades can still be used as a short-term options strategy.

Up until now, I’ve been in an ongoing highly active state of knowledge acquisition and doing, mostly writing the trading program and entering/existing trades. I’ve done so many trades that I earned a reward of a premium subscription service from Interactive Brokers. Reminds me of when I played so many hands 12-tabling Texas Hold’em @ 600 hands/hour on PartyPoker, that I won a laptop for being in the top 10 in flopping sets across their worldwide network in 2006.

I’m finding I’m constantly questioning myself though: What additional value would working and researching harder and more frantically do now relative to just focusing on execution of this defined plan, while accumulating longer term big picture knowledge? Execution on the plan entails trading on a single trading thesis: short call spreads spreads on $VXX since it is decaying. I don’t think there’s much more value to be added simply by being more active, so I’m piloting a plan for the next month to just relax and just give my trades time work out. When they do hit the profit targets, simply execute more short call spreads on $VXX without too much analysis or worrying for now, and wait until another 2-3 months to worry about a much deeper assessment and refinements to the overall strategy.

As an example of what more I wanted to do, I had a much more detailed blog post in mind concerning a very strong inverse correlation between the $DXY (dollar index) and $SPY (US domestic equities index), and how those trading equity indexes are actually unwitting currency traders.

Another blog post idea concerned given an expectation value of the sum of payoffs multiplied by probabilities, the human mind actually prefers a lower expectation if it’s accompanied by higher probability (and frequency) of winning with smaller individual payoffs relative to a higher expectation accompanied by lower probability (and frequency) of winning with higher individual payoffs, and the implications of this for portfolio growth with respect to the theory in the Kelly Criterion. (I suppose I just wrote most of that in this single paragraph.)

In general, this entire strategy has 4 distinct areas where I can allocate my time towards improving.

1. Options theory (Greeks, implied volatility, spreads, etc.)

2. VIX (futures term structure, ETN characteristics, dependence on macroeconomy, etc.)

3. Trading mechanics (Risk and position-sizing, profit targets and optimal recycling of capital, commissions/fees, etc.)

4. Psychology (Maintaining a healthy life overall, making correct trading decisions despite feeling emotions, how trading is a means to a good life instead of life itself, etc.)

Ultimately, trading $VIX is trading macroeconomics in the form of Central Bank policy, geopolitics, macroeconomic indicators, broad market indexes, general sentiment, etc., so I plan to focus my attention on knowledge acquisition in macroeconomics relative to other parts of trading prep/work for now due to its absolute importance, but also do to its relative lack of development in my overall strategy. This will be where my attention to for the next month or so.

I’ll leave it with something I wrote.

—

Hello darkness, my old friend

I’ve come to long $TVIX again

Because Jim Cramer’s crazy creeping

Left its seeds while I was sleeping

And the long $TVIX trade that was planted in my brain

Still remains, and does not seem, to silence

In chaotic charts I watched alone

Narrow spikes of bright red tone

‘Neath the halo of CNBC

I turned to my broker’s trade entry

When my eyes were stabbed by the flash of green neon light

That reached great heights

And broke through, resistance

Then came the naked shorts I saw

10,000 $TVIX shares, maybe more

People twitting without speaking

People liking without reading

People posting insults that voices never shared

And no one dared

Question the trade of Long $TVIX

Fools, said I, you do not know!

Losses in long $TVIX will grow!

Hear Seth’s words that he might reach you

Short $TVIX that he might teach you

And $TVIX price like silent raindrops fell

And continued down, in silence

So people who went long $TVIX, they prayed

To Cramer, “rigged” gods they made

And VIXCentral flashed out its warning

In the Contango that was forming

$VIX term structure said the words of the profits are written in The Fed halls,

And Stock Twit walls

And whispered in screams, Long $TVIX