“The opposite of a true statement is a false statement. The opposite of a deep truth is another deep truth.” – Niels Bohr

The debate rages on concerning whether markets are efficient or not. Exploring the academic complexities and nuances of Market Efficiency would be a major research effort in itself, and even to create well-posed testable hypotheses leading to statistical significant conclusions or even to define what terms mean may be difficult. For example, what constitutes exploitable profitable trading strategies at various timeframes in markets that act according to the weak/semi-strong/strong form of the Efficient Markets Hypothesis?

For the purposes of this post, I will define perfect Market Efficiency as simply a state where all market participants can perfectly price securities using quantitative models of the world based on qualitative assumptions congruent with reality, and are furthermore those market participants have equal capability to intake, process, and act on information to arbitrage and capture market inefficiencies, without such practical disadvantages as transaction costs. Perfect market efficiency is usually associated with the belief that a trader cannot gain a net profitable advantage, but I believe these are distinct independent ideas. I will focus on the applicability to options, in particular the time and volatility premium as priced into options.

Let’s start first with an interesting paradox. How do securities prices move? Are those prices predictable or not? Let’s assume that they indeed are not predictable and move due to randomness. Interestingly, it is this very characteristic of unpredictability and randomness that permits the modeling of the prices according to geometric Brownian-motion, most relevantly as we’ll explore in this post, the Black-Scholes options pricing model. If price movements were indeed “not” random, they would not be able to be modeled, forget “accurately” modeled to such precision with a mathematical model that assumes mathematical idea as geometric Brownian motion.

Let’s assume now that the Black-Scholes options pricing model and its modifications for various market realities like dividends, stock splits, interest rates, discontinuous price jumps, and even more subtle things like constant volatility, are indeed capable of modeling reality perfectly. We’ll also assume that the model can correctly account for extreme events at the tails, which is effectively impossible since there will always be one-off unique unpredictable events in the real world (e.g. CEO gets incapacitated by an escaped chimpanzee from the zoo), but let’s just assume this is not an issue and the markets are behaved for this discussion. For practical context, let’s assume options pricing models are sufficiently robust to model options prices and that outlier events do not happen, at least in the timeframe of a typical options expiration cycle.

The core issue I see is that, although mathematical/statistical models rightfully assume that time is continuous and securities prices evolve in continuous time intervals, this is not the case practically speaking in the real world trading environment.

Paradoxically, the power of an accurate and robust pricing model of the real world is the very reason for trading opportunities, due to the fact that trading timeframes practically are discontinuous and the implications of this fact. For a normal trading week, options trade between 09:30 and 16:00 for 6.5 hours per trading day for 5 days, and do not trading for the other 17.5 hours. Weekends introduce a a 65.5-hour discontinuity from Friday at 16:00 to Monday at 09:30. Despite the pervasiveness and utility of pricing models that use continuous mathematical models, trading for only 32.5 hours (19.3%) of a 168-hour week, and do not trade for the other 135.5 hours (80.7%) of that week.

This leads us to the curious situation where either the following may occur

- Pricing models must work unimpededly during the market off hours

- Off-hours get compressed into the trading hours, with a transitional period to account for an effective jump during the transition from the close of one trading session to the open of the subsequent trading session

How would a savvy trader exploit this? One way would be to always be net short options at closing time on Friday, and take advantage of the extra couple of days of free time decay of the options positions. Note that the prices of options have embedded in them a time premium that erodes, and at an accelerating pace, as time goes on.

Technically, this would also assume that the extra risks of shorting relative to buying options are negligible since, for example, if a large geopolitical event were to cause market underlying prices to crash, the options shortseller would assume extra margin risks as the underlying moves against them, whereas a buyer is only subjected to the risk of the capital already spent for buying), but for the sake of argument let’s assume these are negligible.

However, since we’re assuming perfect models and perfect markets with aware participants, those on the other side of the trade would know that there’d be this extra time decay. To protect themselves, they would adjust accordingly by dialing back options prices so that they do not suffer from the extra time decay over the weekend, and thereby pricing as if there were effectively no weekend.

Paradoxically, this very market efficiency and accuracy of pricing models lead to an efficiency and trading opportunity. How?

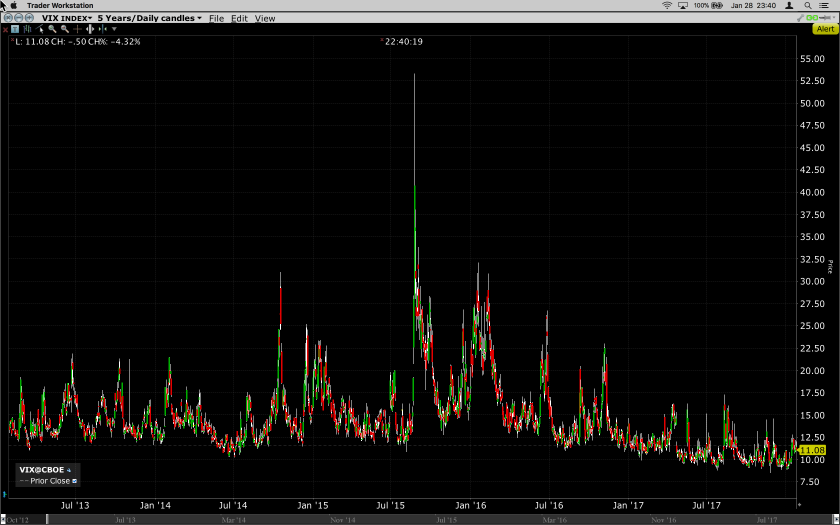

Implied volatility values as expressed by options prices will be artificially low at the close each day as it deflates to account for the anticipated off-time trading, and will be artificially high the next trading day for the same off-time. This effect will be accentuated on weekends relative to intraday weekdays since there is more time involved, and the orderly artificial deflation towards the end of the day and furthermore, the orderly artificial inflation as the next trading day opens will proceed at an increased rate!

Practically, how would a trader structure trades around this phenomenon? There can be two stages:

1. Deflation of implied volatility

During the deflation phase, options prices will decrease from towards the end of the trading day. In this case, you’d want to tend to short options and capture a much faster rate of artificial implied volatility collapse. This effect would be more pronounced on Fridays compared to the rest of the weekdays since there will be more off-time.

2. Re-inflation of implied volatility

The other stage is the re-inflation phase at the beginning of the next trading day.

In this case, you’d want to be net long options and capture a much faster rate of artificial implied volatility re-inflation.

So, paradoxically, it is the very utility of the options pricing models in particular and the efficiency of the markets in general that provides this trading opportunity! Whether markets are efficient or not is an ill-defined theoretical issue at best and is usually irrelevant practically. Here, these trading opportunities involving artificial deflation and re-inflation of options prices are only possible because of the predictable phenomenon that arises from efficient markets. Whereas if the markets were not efficient, these trading opportunities would not exist.

It seems then that the issue of market inefficiency is one that is irrelevant to whether it’s possible to profit from a particular trading strategy or not. Practically speaking, there are many other issues such as risk management and position sizing or selection of specific markets or instruments that may take precedence in importance relative to a particular trading strategy.

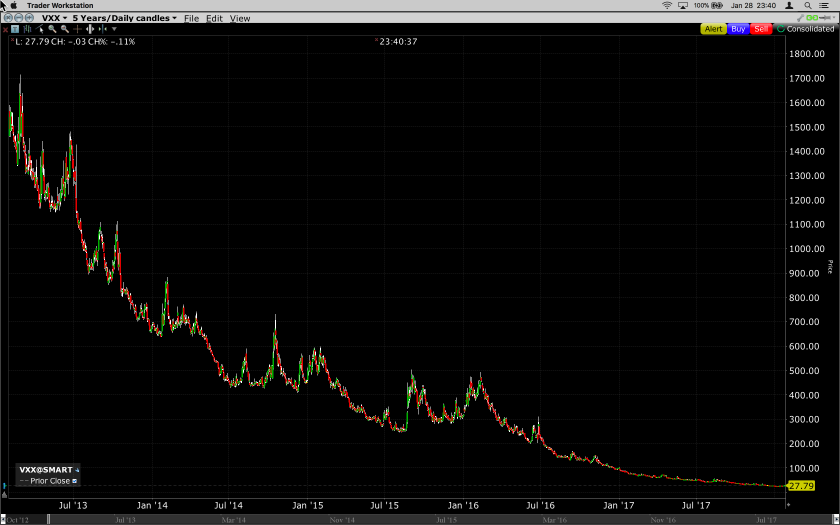

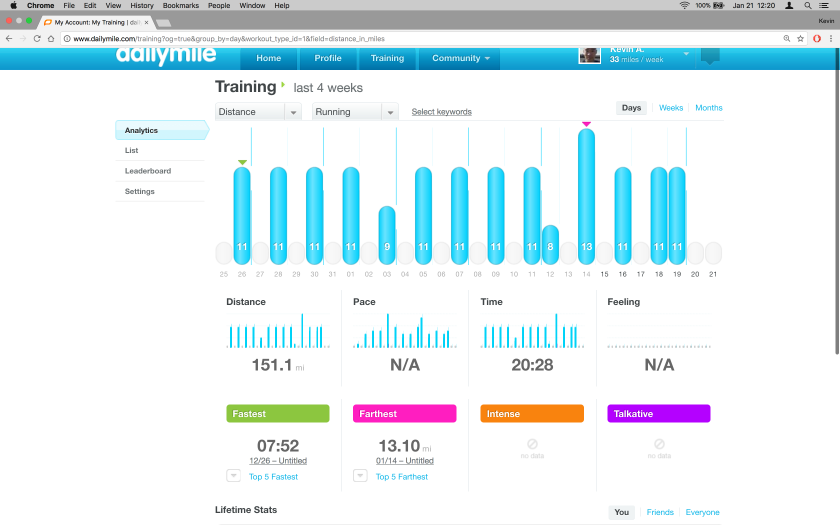

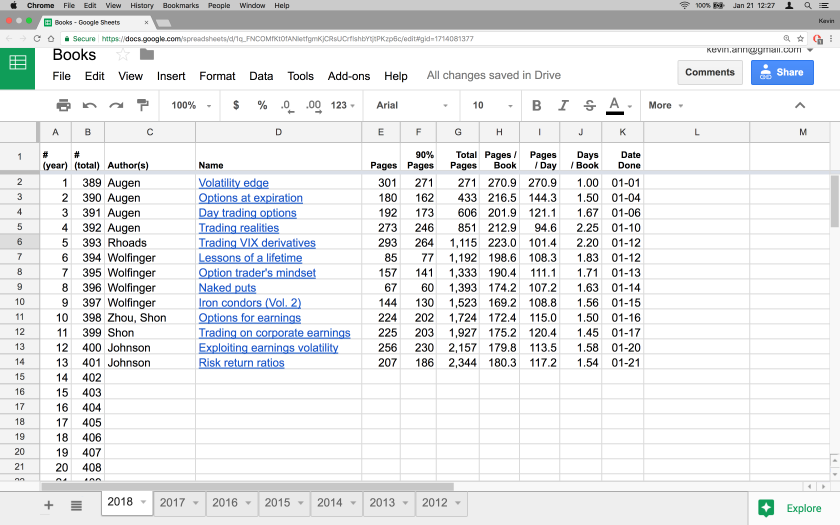

My practical tasks now are to research which underlying securities have an options chain that exhibit this phenomenon most clearly and have the liquidity for it to be practical tradeable so as to overcome the liquidity and transaction costs in the form of bid-ask spreads, slippage, and commissions. My core trading strategy will still be at the timeframe of 45-60 days holding for roughly 2/3 to 1/2 of that time to get to the 50% profit target, but I’d like to use the ideas here to enhance returns at the weekly level around going into and emerging from the weekends.